ANDRITZ supplied Rohrdorfer Zement with Germany’s first CO₂ capture plant. The technology supports the company on its way to CO₂-free cement production.

The 2022 business year at a glance

New record values for order intake, revenue and earnings

ORDER INTAKE

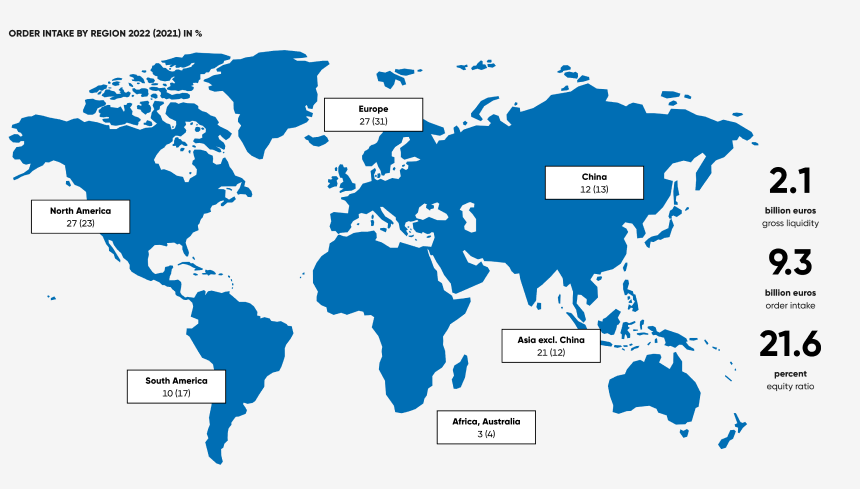

The order intake of the ANDRITZ GROUP saw very favorable development in the 2022 business year and reached a new record level of 9,263 MEUR (+18% compared to 2021: 7,880 MEUR). All business areas were able to increase their order intake significantly compared to the previous year.

Unit | 2022 | 2021 | +/- | |

Pulp & Paper | MEUR | 4,378.7 | 3,774.7 | +16.0%% |

Metals | MEUR | 2,008.6 | 1,778.8 | +12.9% |

Hydro | MEUR | 1,956.6 | 1,565.2 | +25.0% |

Separation | MEUR | 919.5 | 761.0 | +20.8% |

REVENUE

The Group’s revenue reached 7,543 MEUR, which is also the highest figure in the company’s history (+17% compared to 2021: 6,463 MEUR). All four business areas succeeded in increasing their revenue – in some cases significantly – compared to the previous year.

Unit | 2022 | 2021 | +/- | |

Pulp & Paper | MEUR | 3,591.1 | 3,070.6 | +17.0% |

Metals | MEUR | 1,621.2 | 1,366.1 | +18.7% |

Hydro | MEUR | 1,539.0 | 1,345.1 | +14.4% |

Separation | MEUR | 791.6 | 681.2 | +16.2% |

ORDER BACKLOG

The order backlog of the ANDRITZ GROUP amounted to 9,977 MEUR as of December 31, 2022, and was thus 22% higher than the reference figure for the previous year (December 31, 2021: 8,166 MEUR). All four business areas recorded a significant increase in order backlog compared to the previous year.

EARNINGS

The Group’s operating result (EBITA) increased in line with revenue and reached a new record level of 649 MEUR (+19% versus 2021: 547 MEUR), as did revenue. All four business areas recorded an - in some cases significant - increase in operating result. Profitability (EBITA margin) increased to 8.6% (2021: 8.5%).

NET WORTH POSITION AND CAPITAL STRUCTURE

Total assets amounted to 8,492 MEUR (December 31, 2021: 7,673 MEUR), while the equity ratio increased to 21.6% (December 31, 2021: 20.4%).

Liquid funds amounted to 2,051 MEUR as of December 31, 2022 (1,838 MEUR as of the end of 2021), and net liquidity increased significantly to 983 MEUR (703 MEUR as of the end of 2021).