ANDRITZ supplied Rohrdorfer Zement with Germany’s first CO₂ capture plant. The technology supports the company on its way to CO₂-free cement production.

The ANDRITZ share

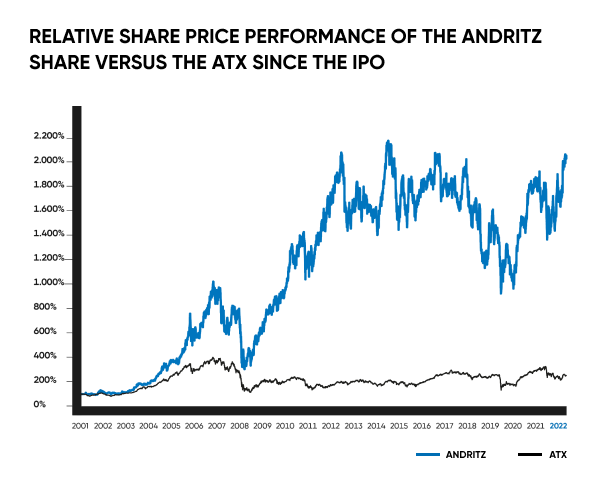

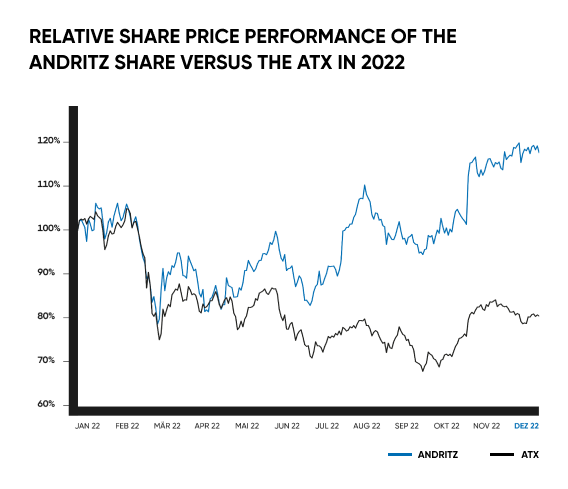

SHARE PRICE DEVELOPMENT

Development of the international stock and financial markets was entirely overshadowed by the war in Ukraine and its impact on the global economy. High energy and raw material prices, bottlenecks and delays in the global supply chains, and the record inflation rates that all this causes put pressure on virtually all share indices on the main stock exchanges in Europe, the USA, and Asia. Furthermore, the rigorous interest policy pursued by the American and European central banks in order to fight the high inflation contributed substantially to the drop in share prices on the international stock markets.

In this stock exchange environment, the ANDRITZ share price developed favorably and increased by +18.0% in 2022. The ATX, the leading share index on the Vienna Stock Exchange, dropped significantly by 19% during the same period. The highest closing price of the ANDRITZ share was 54.55 EUR (December 14, 2022), and the lowest closing price 36.04 EUR (March 4, 2022).

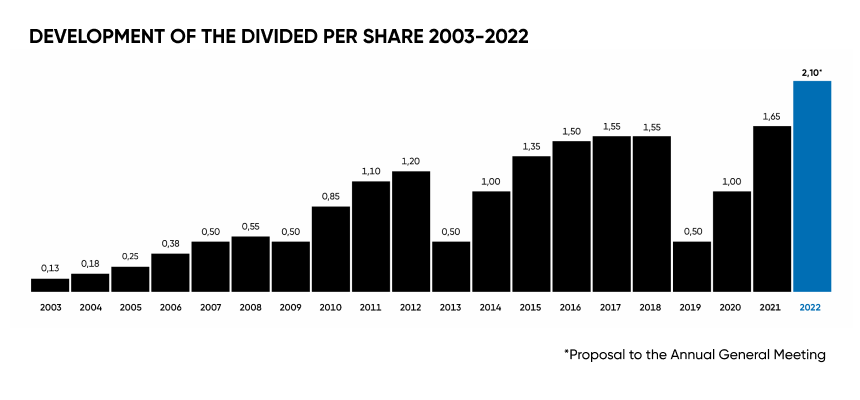

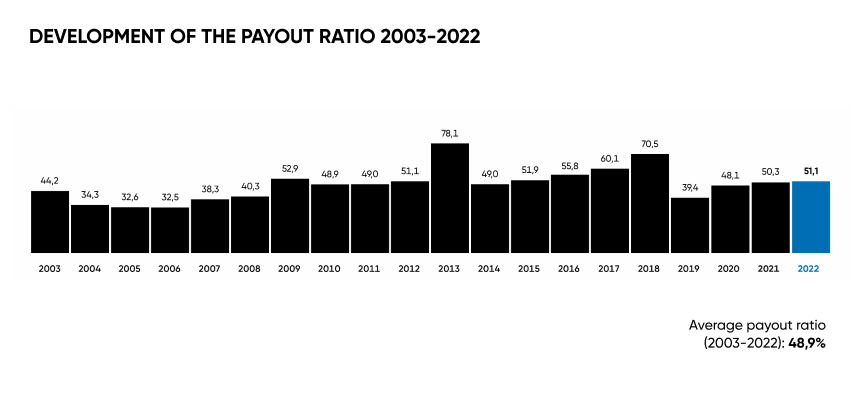

LONG-TERM DIVIDEND POLICY

ANDRITZ pursues a dividend policy oriented towards continuity. Depending on how business develops and on any large-scale acquisitions, ANDRITZ’s goal is to distribute an average of 50–60% of the net profit to the shareholders in the long term.

RELATIVE SHARE PRICE PERFORMANCE OF THE ANDRITZ SHARE VERSUS THE ATX

Since the IPO

RELATIVE SHARE PRICE PERFORMANCE OF THE ANDRITZ SHARE VERSUS THE ATX

In 2022

STABLE AND WELL-BALANCED SHAREHOLDER STRUCTURE

ANDRITZ has a stable and well-balanced shareholder structure. Around 31.5% of the ANDRITZ AG share capital is partly held directly and partly indirectly by Custos Privatstiftung and by Wolfgang Leitner, a member of the ANDRITZ AG Supervisory Board, respectively. 30.72% is owned by Custos Vermögensverwaltungs GmbH and 0.77% by Cerberus Vermögensverwaltung GmbH. With a free float of around 68.5%, national and international institutional investors and private investors make up the majority of the shareholders. Most institutional investors come from the UK, Austria, and Germany, while the bulk of the private investors are from Austria and Germany.

TRANSPARENT COMMUNICATION POLICY

Regular and transparent communication with institutional and private shareholders has been the focus of investor relations activities since the ANDRITZ IPO in 2001. In 2022, ANDRITZ took part in many roadshows and investor conferences, most of which were held online. In addition, the Investor Relations team conducted numerous video and conference calls to inform investors and analysts about the main key figures, the company’s strategic and operative development, current events and the impact that the war in Ukraine and also the COVID-19 pandemic have had on the individual markets, and about current ESG topics.

BROAD RESEARCH COVERAGE

In addition to overall economic and company-specific considerations, the recommendations and share price expectations voiced by analyst firms play an important role in investment decisions by shareholders. The following international banks and investment houses publish analysis reports on ANDRITZ at regular intervals: Baader Bank, BNP Paribas Exane, Deutsche Bank, ERSTE Bank, Hauck & Aufhäuser, HSBC Trinkaus, J.P. Morgan, Kepler Cheuvreux, Raiffeisen Bank International, UBS, Warburg Research, and Wiener Privatbank.

The latest information on research coverage and consensus estimates is available on the Investor Relations page of the ANDRITZ web site andritz.com/research-coverage.

KEY FIGURES OF THE ANDRITZ SHARE

Unit | 2022 | 2021 | 2020 | 2019 | 2018 | |

Earnings per share | EUR | 4.14 | 3.28 | 2.08 | 1.27 | 2.20 |

Dividend per share | EUR | 2.101 | 1.65 | 1.00 | 0.50 | 1.55 |

Payout ratio | % | 50.7 | 50.3 | 48.1 | 39.4 | 70.5 |

Price-earnings-ratio | - | 12.93 | 13.84 | 18.02 | 30.24 | 18.24 |

Equity attributable to shareholders per share | EUR | 18.69 | 15.86 | 12.64 | 12.05 | 13.02 |

Highest closing price | EUR | 54.55 | 50.85 | 38.82 | 45.06 | 53.50 |

Lowest closing price | EUR | 36.04 | 36.66 | 24.36 | 29.88 | 38.88 |

Closing price as of end of year | EUR | 53.55 | 45.38 | 37.48 | 38.40 | 40.12 |

Market capitalization | MEUR | 5,569.2 | 4,719.5 | 3,897.9 | 3,993.6 | 4,172.5 |

Performance | % | +18.0 | +21.1 | -2.4 | -4.3 | -14.8 |

ATX weighting | % | 7.7744 | 5.3766 | 6.1243 | 5.6622 | 7.1045 |

Average trading volume2 | - | 288,913 | 313,879 | 628,900 | 511,221 | 354,084 |

Source: Vienna Stock Exchange

1) Proposal to the Annual General Meeting

2) Double counting - as published by the Vienna Stock Exchange

FINANCIAL CALENDAR 2023

The financial calendar with updates and information on the ANDRITZ share can be found on the Investor Relations page