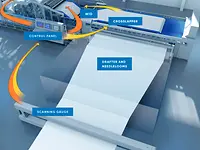

Model production line for needlepunch systems for the fabrication of geotextiles

Evolution in needlepunch

Markets, trends, developments and innovations in one of the most diverse process technologies for the nonwovens industry

Guillaume Julien, Global Sales Director for Engineered Textile, shares his valuable impressions of markets and products manufactured with the Needlepunch process technology in this article. An impressive manifesto and at the same time an expression of dedication to the versatility of durable nonwovens products.

NEEDLEPUNCH MARKET OVERVIEW

Needlepunch versatility has always been a key parameter for this attractive technology segment to be able to interact with many different areas, from geotextiles & flooring to automotive, filtration to synthetic leather, roofing to insulation, sound absorption to bedding, aircraft carbon brakes to ceramics, in addition to numerous niche markets. This variety of applications and markets always offers different dynamics from one period to the next, each segment having its own distinct cycle. Global economic peaks and troughs as a machine manufacturer or roll-good producer are thus very much balanced when compared to single-segment industry players, resulting in less barriers to investment because of a lower risk approach.

Despite challenging years, the journey of success will continue

As a global trend, we can acknowledge that after a calm period in early 2020 just after the COVID outbreak, needlepunch rapidly recovered with a tailwind until Q3 2023, in Northern America, Europe and of course Asia.

2024 may be more challenging for the needlepunch market compared to previous years. However, equipment manufacturers have observed that investing during uncertain times often leads to a competitive edge over rivals at the end. The calmer market is attributed to economic uncertainty from geopolitical issues like the Ukraine war, raw material inflation in Western countries, and significant elections in many countries around the world.

Larger demand for capacities as a market driver

At ANDRITZ, we however foresee a positive trend on the market as far as 2025 is concerned, after a good start of the year for needlepunch. In addition, we believe the global market should keep on growing in the years to come, whether in terms of additional capacity from new complete lines or existing lines improvement via single equipment sales. In June 2024, anticipating continuous growth, ANDRITZ decided to build and inaugurate a new 2,000 square meter needlelooms workshop in Elbeuf, France. This expansion aims to boost production capacity and reduce delivery times during peak periods.In addition to well-known Western markets, we particularly note a high potential in the Middle East, Central Asia and the Far-East, which ANDRITZ is supporting from its Hubs in France, India and China in order to remain close to our customers at all times. The Russian market, for which ANDRITZ had a predominant position for needlepunch until the conflict with Ukraine started in 2022, is unfortunately still inaccessible due to sanctions linked to the situation.

ANDRITZ Technical center for needlepunch in Elbeuf, France

NEEDLEPUNCH MARKET DEMAND

Needlepunch market demand is seen as very heterogeneous from one market to the other. Indeed, ANDRITZ is now able to demonstrate needlepunch process can be used for solutions ranging from light weights (from 30 gsm) to heavy weights (4,200 gsm) and thus drastically expanding the range of action for needlepunch applications when compared to the (recent) past.

Which end-applications are big in which region of the world

Geotextile is still a major application of needlepunch nonwovens due to countries' growing demand for infrastructure and global GDP growth. ANDRITZ’s proven concept for needlepunch lines up to 2,000 Kg/hour with ProWin™ patented technology for web weight regulation is a key asset to keep enabling end-users to benefit from a lower cost of ownership and thus a greater market competitiveness in the long term. Although the automotive market is not at its peak for several reasons, which vary from one geographical area to the other, new capacities are being installed each year by ANDRITZ, with a clear trend in 2024 for the wheel arch-liner in the United States or visual surface aspect nonwovens in Europe thanks to the ongoing development of needle patterns for aesthetics. Needlepunch for airlay production, which is also one of ANDRITZ’s webforming technologies, linked to sound absorption and insulation, is also significant. Moreover, velour needlelooms for the automotive and shoe industries complete the picture, notably with a strong demand from Asia.

Filtration and synthetic leather are popular in Asia

Filtration and synthetic leather however remain the main drivers in Asia, in addition to stitch-bonding with very promising market activity in 2025. ITMA Asia fair in Singapore (in October) and SINCE fair in Shanghai (in December) should be extremely positive events in the region for needlepunch in 2025 and should stimulate even more projects for 2026.

Finally, the processing of natural & mineral fibers, in addition to recycled (shoddy) fibers, is benefiting from a growing interest from the needlepunch market, with more mature volumes thus requiring more sophisticated needlepunch lines, including dedusting & wiring cleaning systems. This allows maintenance time to be minimized and the final quality of needlepunch products to be optimized. ANDRITZ can then process 100% recycled fibers in its needlepunch solutions, supporting eco-friendly production without compromising quality. These initiatives cater to a wide range of applications from floor protection felts to technical felts including automotive interiors.

INVESTMENTS AND NEW ANDRITZ DEVELOPMENTS

Despite market uncertainty in 2024, nonwovens producers kept investing in new lines or new equipment that would help improve productivity and/or quality. Some were, of course, intended to replace existing lines but most of them were ultimately additional capacity, demonstrating a certain confidence in the future.

As a machine manufacturer, it is essential to be able to support the business case of our customers by following a structured procedure:

- Factually demonstrate the equipment/line’s ability first, thanks to our database and associated digital tool for production simulations.

- At a later stage, these simulations can be confirmed through trials at our technical center in Elbeuf, France, as textile parameters can significantly vary from one fiber to the next (even from the same fiber type and dtex, textile behavior can be different from one fiber supplier to the other).

Which route is best from our customer's perspective?

This is the recommended route for our customers: By optimizing their line configurations with facts and figures and demonstrating best-in-class nonwoven product design, our customers and their potential investors/shareholders have no doubts about the manufacturer’s capability to handle the desired product correctly (both in terms of key parameters and the visual surface aspect). With each needlepunch line representing several million euros, each investment is therefore critical in terms of CAPEX and OPEX, responding to a long process of questions, business plans & feasibility studies. This usually results in decision-making processes from six to twenty-four months depending on the customer's profile and the complexity of the project. We can agree on the fact the worldwide market is focusing more and more on fast ROI and added value to overwhelm the existing competition in a very short-term perspective.

No two eggs are alike : Each line is tailor-made for the customer

At ANDRITZ, we do not offer standard lines, meaning each needlepunch line offered is designed for specific requirements expressed by the customer, allowing us to use very different configurations and equipment types from one market segment to the next, such as our Isolayer, Battcruise, Elliptical Orbital-type cylinder pre-needleers’ range, Zeta drafters and many other critical pieces of equipment that clearly make a difference in the productivity and/or quality of the process (tensile strength, abrasion tests, MD/CD ratio, CV%, thickness). A few improved percentage points here and there can rapidly help to generate the right EBITDA at the end of the year for our customers, notably when considering SCADA supervision and Industry 4.0 solutions for line monitoring and preventive maintenance (respectively called “Expert” & “Metris” at ANDRITZ). In a more complex financial and economic environment, a clear focus is given in this direction by our customers to further anticipate and optimize their production means.

Great Service is more than just the icing on the cake

The service dimension is also a key parameter in the final decision-making, as end-users need 24/7 remote assistance, fast spare parts’ dispatch whenever needed and careful follow-up for upgrades and retrofits, whether mechanical or electrical. Textile support is also generally even more valued than in the past, very probably due to higher employee turnover since the COVID period and the overall age structure in the industry.

Finally, assistance for financing packages is a strong asset for a machine manufacturer in order to support its customers, as financing requires a thorough market understanding, each market having its own rules and banking processes, as well as good expertise with credit insurance institutes. We observed that the solid structure of a large group like ANDRITZ, which is also very active in major paper industry projects around the globe, is a plus for several decision-making processes every year for the needlepunch industry.

RECENT ADVANCEMENTS

ANDRITZ ProWin™ system represents a significant advancement in web weight evenness control, combining ANDRITZ's technologies for optimal fiber weight profiling and enhancing production efficiency. The benefit of ProWin™ is twofold:

Obviously, the market already knows that ProWin™ enables optimization of CV% figures, in order to save significant raw materials by up to 7% of fibers a year. The associated return on investment is extremely rapid. We must admit that it is actually a delightful experience for our customers and ourselves during each and every demonstration carried out on our Elbeuf demo line, that when we put ProWin™ into action, there is an immediate Wahoo moment, seeing ProWin™ making such a difference first-hand with amazing and visible production improvements.

The second benefit is the integration of an Autopilot assistant into the line, as Patented ProWin™ also minimizes the level of instantaneous acceleration, resulting in the same battforming equipment being able to run faster with less mechanical stress (and a more optimized product regularity). This leads to smart parameter controls, as the line settings for battforming parameters will be self-adjusting, and production quality will be optimized and less dependent on operator qualification.

It is interesting to note that the ProWin™ system works whatever the fibers, thus addressing the market's wide range of applications and weights: ProWin™ can reduce the CV% by a factor of at least 3 when compared to conventional non ProWin™ lines, setting the benchmark for web weight regularity on crosslaid applications.

neXloom Elliptica-type DF-4 needleloom

To achieve the best results for light weights, last year, ANDRITZ released its neXloom Elliptica-type DF-4 needleloom (4-board elliptical needleloom) associated with the innovative ANDRITZ Battcruise equipment and the above mentioned ProWin™ web weight regulation system. This combination enables running speeds of up to 30 m/min for 50 gsm fabrics while maintaining superior surface quality.

For heavy weight sound absorption and insulation panels (up to 4,200 gsm), ANDRITZ developed a specific proven needlepunch line concept through a single neXloom HL-type DF4 needleloom, offering an alternative to airlay technology with a different batt structure (carded/crosslapped vs Airlay as an alternative). This configuration contributes significantly to lowering the overall CAPEX with a single run process feeding the thermo-bonding unit directly (no longer any requirement for an offline consolidation line).

All above solutions can be tested at ANDRITZ technical centers in France. Our ANDRITZ US-based team will be glad to highlight the above solutions in greater detail to the Northern America market in Miami beach in late April during the IDEA fair (find ANDRITZ at booth 4216).

neXloom Elliptica-type DF-4 needleloom

Close-up Elliptica DF4 needles and holes

Needleloom DF4 in operation

NEEDLEPUNCH MARKET CHALLENGES

Needlepunch is, and will remain a world of innovations for which research & development must remain active for the sake of tomorrow’s products, whether they be carded/crosslapped or processed into airlay equipment. ANDRITZ Nonwovens and Textile is therefore proud to develop new patents each year thanks to the research of its technology experts and will continue releasing new cutting-edge technology in the coming months, thereby contributing to the major expansion of the needlepunch market. Training new talents is thus key in order to master the expertise for the long-term (for external support as well as for the transmission of internal expertise). To continue offering specific and detailed professional textile and mechanical support to our various contacts, as well as create a stimulating working environment, ANDRITZ teamed up with textile engineering schools for specific partnerships and collaborative projects to think about future successes and for Creating Growth That Matters.

SUSTAINABILITY IN THE NEEDLEPUNCH MARKET

When thinking of sustainability, we automatically think of natural fibers like hemp & flax for instance. Bast fibers, recognized for their lower carbon footprint compared to synthetics, are indeed integral to the green transition, as they are considered zero-waste raw materials. With extensive experience in decortication, refining, and cottonizing bast fiber production lines, ANDRITZ enables seamless integration into nonwoven processes. A growing demand for such sustainable fibers can be observed from the Needlepunch market (carded/crosslapped and airlay) and used in several key markets, such as the automotive industry, building insulation, geotextiles, construction, bedding & garment, often remaining in the local ecosystems of harvested areas, benefiting local communities and reducing long-distance competition.

The big trend to natural and recycled fibers

The recent JEC World 2025 exhibition in early March in Paris was a clear signal that hemp, flax and even basalt are increasingly being considered for composite structural parts as well, whether it be for the aerospace, aeronautics, automotive or even boating industries. In Asia, a clear trend towards jute fiber can be observed and some other exotic fibers may also be of interest, such as coconut fiber, camel hair and pineapple leaf, among others; some are even being considered for sustainable garments, luxury bags or packaging, replacing synthetic products or genuine leather.

Nevertheless, we tend to easily forget recycled fibers (shoddy) are also a significant aspect of bio-sourced fibers. Recycling textile waste from the garment industry generates a virtuous circle, producing recycled fibers at a lower production cost and with a positive environmental impact. ANDRITZ also ensures that the loop is closed by offering upstream sorting and tearing lines to go from clothes to regenerated fibers ready to be used for spinning as well as for a wide range of nonwoven applications. Amongst others, this recycled fiber is then used for needlepunch and/or thermo-bonding applications (once again, carded/crosslapped or for further airlay process).

ANDRITZ covers each step of the value chain

When considering bio-sourced fibers (recycled or natural fibers), we thus grant our partners the assurance of knowing that ANDRITZ is a one-stop-shop, from fiber preparation to needlepunch end-products, for a seamless experience and a seamless philosophy regarding equipment.

By providing multi-technology one-stop-shop projects, ANDRITZ Nonwoven & Textile enables the industry to advance greener initiatives while ensuring fully economically viable solutions.

The shift towards ecological products is driven by the need to reduce environmental impact. Bast fibers, with their lower carbon footprint compared to synthetic fibers for example, are a key component in this transition. By vertically integrating the fiberizing process, our customers can control the quality and consistency of the fibers, improve their production efficiency and optimize their logistics costs while achieving complete supply chain independence.

Adopting a vertically integrated approach also minimizes risks, reassuring partners that their investment is secure and aligned with the growing demand for eco-friendly products.