The ANDRITZ share

SHARE PRICE DEVELOPMENT

Developments on the international financial markets in 2021 were characterized by the economic recovery in the world’s most important economic regions. Almost all of the share indices on the main stock exchanges in Europe, the USA and Asia were able to make up for the sharp decline caused by the Covid-19 pandemic in the previous year and even achieved record levels due to the favorable economic and earnings perspectives for the companies listed.

In this stock exchange environment, the ANDRITZ share price rose by 21.1% in 2021. During the same period, the ATX, the leading share index on the Vienna Stock Exchange, increased by 38.9% due to the strong price performance of the highly weighted banking sector. The highest closing price of the ANDRITZ share was 50.85 EUR (November 4, 2021), while the lowest closing price was 36.66 EUR (January 5, 2021).

LONG-TERM DIVIDEND POLICY

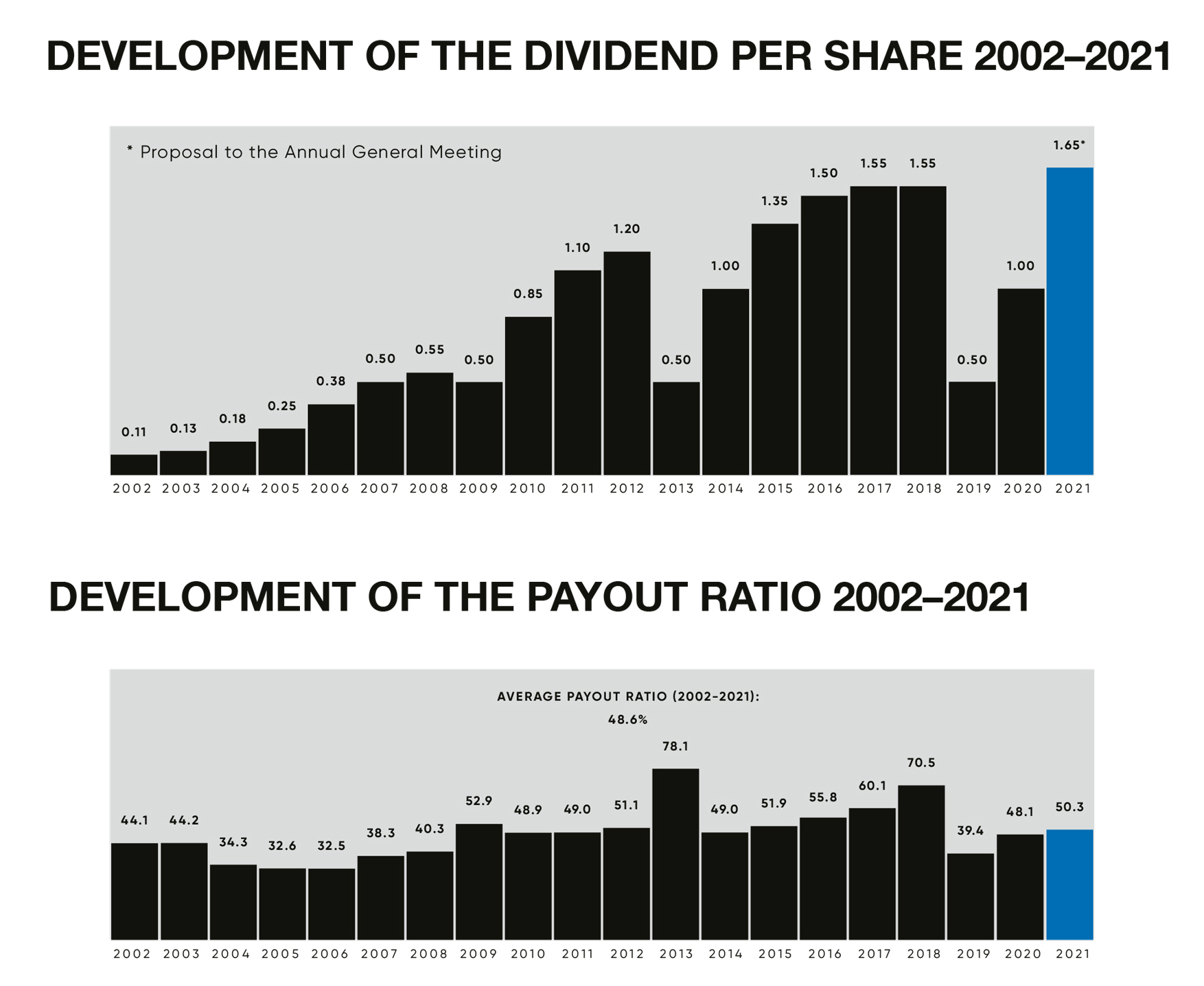

ANDRITZ pursues a dividend policy oriented towards continuity. Depending on how business develops and on any large-scale acquisitions, ANDRITZ’s goal is to distribute an average of 50-60% of profits earned to the shareholders in the long term.

RELATIVE SHARE PRICE PERFORMANCE OF THE ANDRITZ SHARE VERSUS THE ATX

Since the IPO

RELATIVE SHARE PRICE PERFORMANCE OF THE ANDRITZ SHARE VERSUS THE ATX

In 2021

STABLE AND WELL-BALANCED SHAREHOLDER STRUCTURE

ANDRITZ has a stable and well-balanced shareholder structure. Around 31.5% of the ANDRITZ AG share capital was held – some directly and some indirectly – by Wolfgang Leitner, CEO of ANDRITZ AG, on the balance sheet date. A holding of 30.72% is owned by Custos Vermögensverwaltungs GmbH and 0.77% by Cerberus Vermögensverwaltung GmbH.

With a free float of just under 70%, national and international institutional investors and private investors make up the majority of the shareholders. Most of the institutional investors come from the UK, Austria, and Germany, while the bulk of the private investors are from Austria and Germany.

TRANSPARENT COMMUNICATION POLICY

Continuous and transparent communication with institutional and private shareholders has been the focus of investor relations activities since the ANDRITZ IPO in 2001.

Due to the Covid-19 pandemic, the resulting travel restrictions and also for safety reasons, roadshows and investor conferences were conducted solely as virtual events in 2021. In addition, numerous video and conference calls were held to report and provide information on the main key figures and on the company’s strategic and operative development.

At the virtual ANDRITZ Capital Market Day 2021, the Executive Board provided information on current developments and expectations for the business areas and on the goals of the ANDRITZ GROUP in the medium to long term.

BROAD RESEARCH COVERAGE

In addition to overall economic and company-specific considerations, the recommendations and share price goals voiced by analysts play an important role in investment decisions by shareholders.

The following international banks and investment houses publish analysis reports on ANDRITZ at regular intervals: Baader Bank, Deutsche Bank, ERSTE Bank, Goldman Sachs, Hauck & Aufhäuser, HSBC Trinkaus, J.P. Morgan, Kepler Cheuvreux, Morgan Stanley, Raiffeisen Bank International, UBS, Warburg Research, and Wiener Privatbank.

The latest information on research coverage and consensus estimates is available on the Investor Relations page at andritz.com/research-coverage

KEY FIGURES OF THE ANDRITZ SHARE

Unit | 2021 | 2020 | 2019 | 2018 | 2017 | |

Earnings per share | EUR | 3.28 | 2.08 | 1.27 | 2.20 | 2.58 |

Dividend per share | EUR | 1.651 | 1.00 | 0.50 | 1.55 | 1.55 |

Payout ratio | % | 50.3 | 48.1 | 39.4 | 70.5 | 60.1 |

Price-earnings-ratio | - | 13.84 | 18.02 | 30.24 | 18.24 | 18.25 |

Equity attributable to shareholders per share | EUR | 15.86 | 12.64 | 12.05 | 13.02 | 12.77 |

Highest closing price | EUR | 50.85 | 38.82 | 45.06 | 53.50 | 54.87 |

Lowest closing price | EUR | 36.66 | 24.36 | 29.88 | 38.88 | 44.32 |

Closing price as of end of year | EUR | 45.38 | 37.48 | 38.40 | 40.12 | 47.09 |

Market capitalization | MEUR | 4,719.5 | 3,897.9 | 3,993.6 | 4,172.5 | 4,896.8 |

Performance | % | +21.1 | -2.4 | -4.3 | -14.8 | -1.3 |

ATX weighting | % | 5.3766 | 6.1243 | 5.6622 | 7.1045 | 6.2680 |

Average trading volume2 | - | 313,879 | 628,900 | 511,221 | 354,084 | 306,296 |

Source: Vienna Stock Exchange

1) Proposal to the Annual General Meeting

2) Double counting - as published by the Vienna Stock Exchange

FINANCIAL CALENDAR 2022

The financial calendar with updates and information on the ANDRITZ share can be found on the Investor Relations page andritz.com/share