1.

What has happened to supply and demand of pulp grades over the last 10 years?

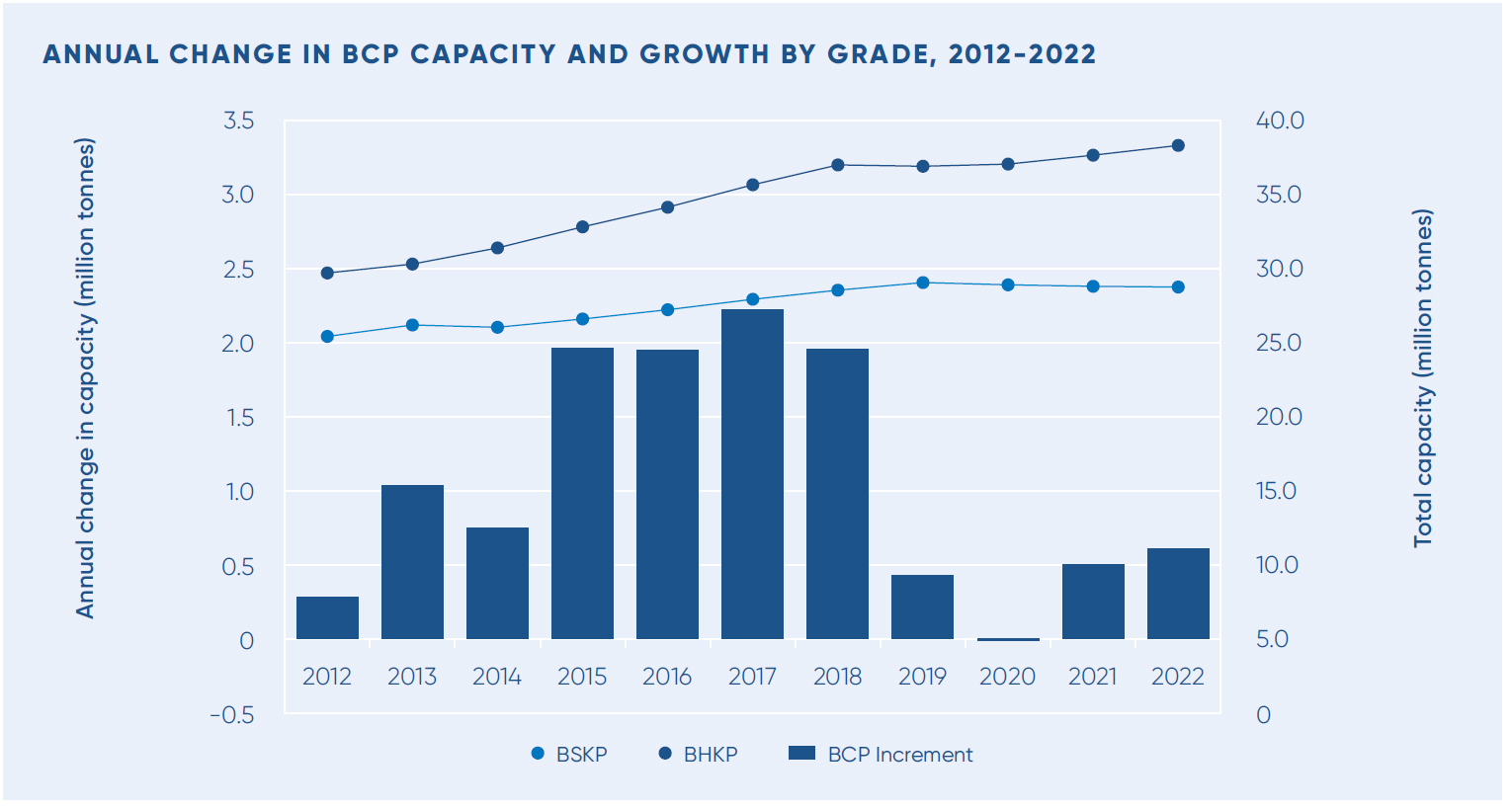

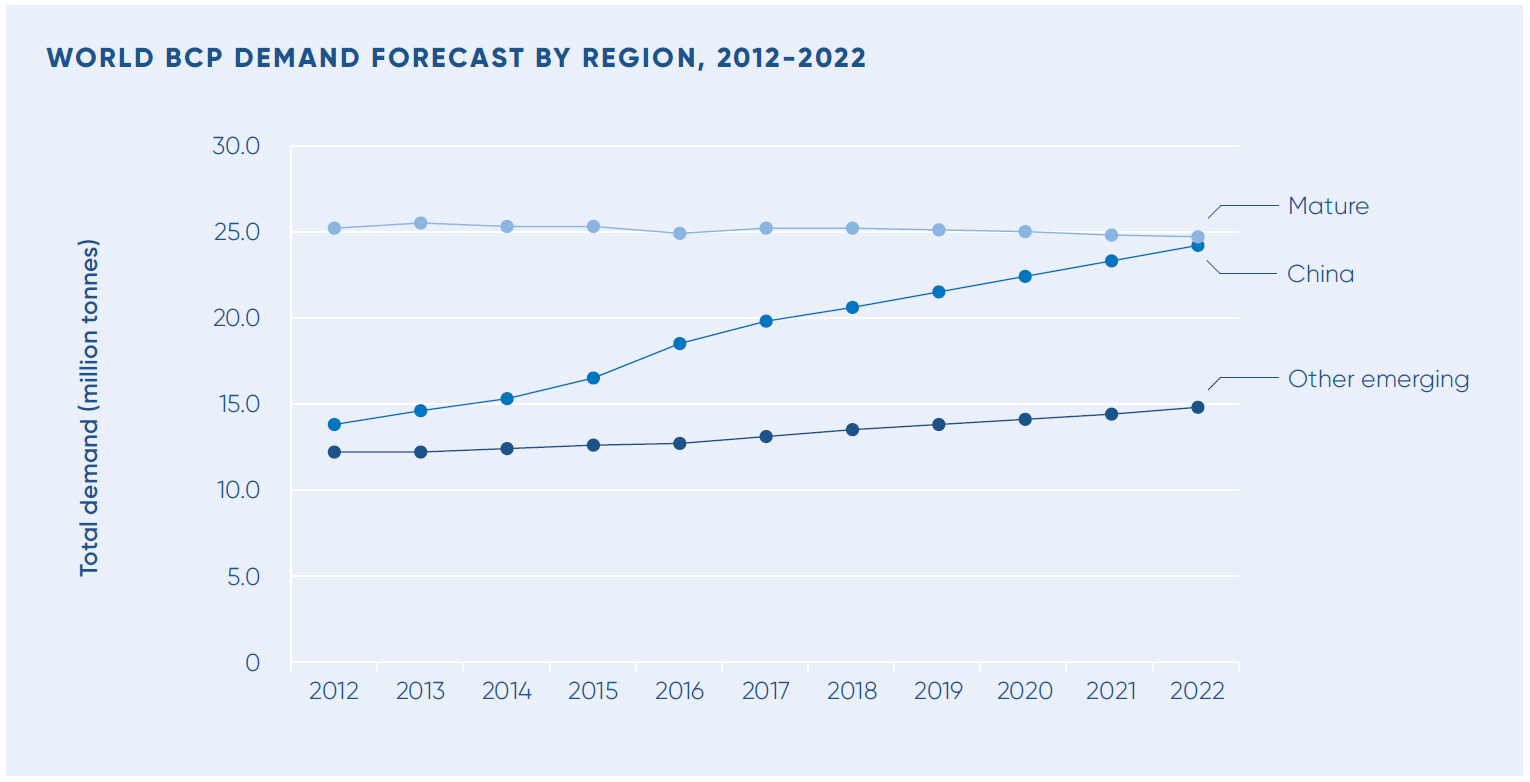

Demand for bleached chemical market pulp has grown by 11.5 million tonnes since 2007 to total 58.1 million tonnes last year (an average increase of 2.2% per annum). During this period, the Chinese market grew by 13.1 million tonnes, offsetting declines in the mature markets of North America, Western Europe, Japan and Oceania. Modest growth is also reported in Eastern Europe, other Asian countries, and Latin America. BHKP demand has grown by 9 million tonnes during this period and the BSKP market has expanded by 3.5 million tonnes. Demand for sulphite has fallen by 1 million tonnes. Of the growth in BHKP, 10.1 million tonnes has been BEKP and 2.2 million tonnes has been Asian hardwood pulp. This growth has offset declines in birch, NBHK, and SBHK.