1.

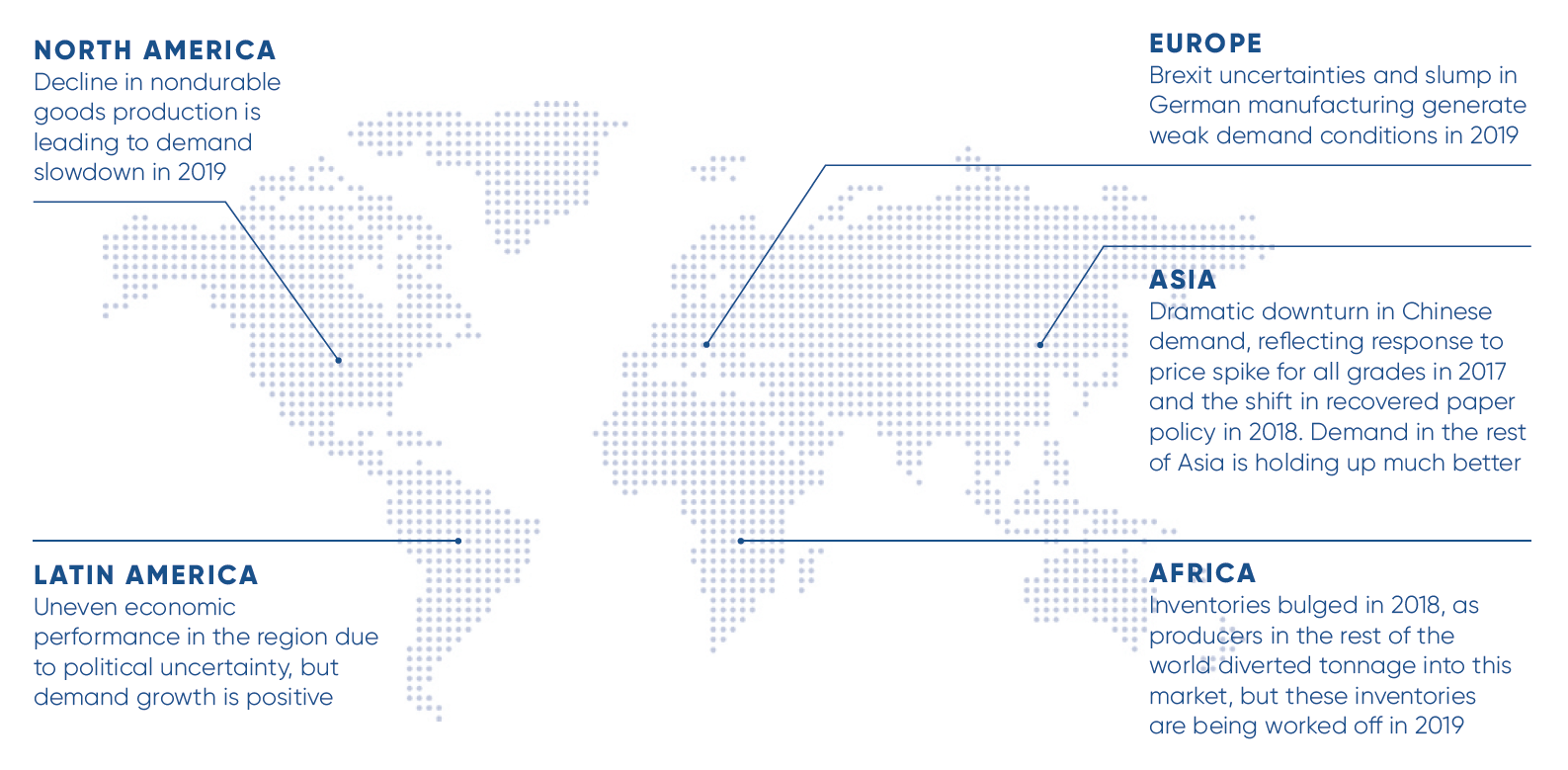

Global paper packaging demand growth averaged 6.9 million tonnes per year between 2014 and 2017, up substantially from the 5.0 million tonne average increase between 2008 and 2013. However, demand growth slowed to 1.7 million tonnes in 2018 and is poised to decline 4.0 million tonnes in 2019. The downturn in global manufacturing activity in response to increased trade tensions has been the biggest factor behind the slowdown, but Chinese demand is also being affected by shifts in government policy.